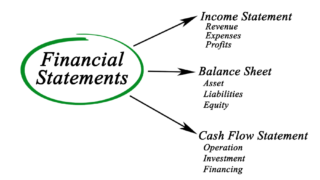

Accounting

Accounting How to Create a Cash Flow Table: A Guide for Small Business Owners

Explore our comprehensive guide on creating cash flow statements specifically tailored for SME owners. Learn how to effectively manage your business finances and prepare for unforeseen financial needs with essential insights and step-by-step instructions.